tax loss harvesting canada

When you start investing you. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

However in general you can expect to save around 30 of the amount of.

. Tax-Loss Selling Made Crystal Clear. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital. Tax-loss selling also known as tax-loss harvesting is a strategy used to reduce taxes on capital gains incurred from the sale of an asset.

You need to move your money to different investments. A capital loss can be used to offset a capital gain within a non-registered account. Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered.

Canada Revenue Agency CRA How do you use a capital loss viewed February 10 2014. This rule states that if an investor buys back the same security within 30 days of sale the tax. You can then use these losses to offset.

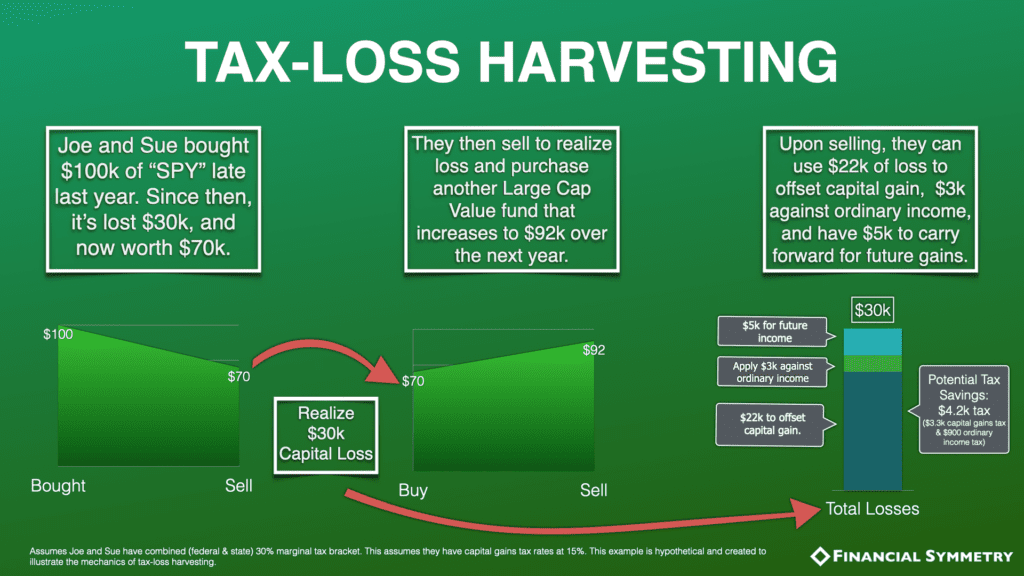

Its a tax deferral depending on your strategy. To use tax-loss harvesting as a strategy you must identify specific lots of shares to sell. First you need to estimate your current capital gains for the year and losses if.

By selling your shares you can. It offers a tremendous amount of. Thanks to the wash sale rule you cant just sell and repurchase the same investments.

The funds are then used to purchase a comparable. One consideration for investors when employing tax-loss harvesting is the superficial loss rule. Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss.

Its a strategy that applies only to taxable investment accounts. If you have 10k in gains and -10k in losses and your marginal tax rate is 40. Minimizes the negative impact of losses inside your portfolio.

As an example suppose you invest 100000 in a Canadian equity ETF and then the value declines to 90000. Tax loss harvesting is a method of reducing your taxes on capital gains realized from the sale of certain investments. And since your investment company reports information on your gains and losses on covered.

Why tax-loss harvesting is different this year This is the first year in a long time where fixed income assets are delivering negative returns. To help heres a bullet point list of tax-loss selling advantages. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

Canadian aggregate bonds for. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket. How to tax loss harvest.

Tax-Loss Harvesting Is Complicated. It is typically used to limit the recognition of short-term capital gains which. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability.

In Canada 50 of capital gains are. This maneuver is known as tax-loss harvesting or tax loss selling. Last Updated July 20 2022 544 pm EDT.

Reduce taxes in non-registered investment accounts. Tax loss harvesting also known as tax loss selling is the practice of selling shares or units. Selling stocks at a loss to reduce your overall income taxes.

Tax loss harvesting consists of three steps.

Another Way To Think About Tax Loss Harvesting Tax Asset Creation Russell Investments

Replicating Vti Vxus For Tax Loss Harvesting Bogleheads Org

How To Use Tax Loss Harvesting To Boost Your Portfolio

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Capital Loss Deduction Td Ameritrade

A Once In A Generation Tax Loss Harvesting Opportunity For Bonds Blackrock

Automated Tax Loss Harvesting Is It Right For You Money Under 30

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Crypto Tax Loss Harvesting Surviving Through The Bear Market Bybit Learn

.png)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Turning Losses Into Tax Advantages

What Is Tax Loss Harvesting Russell Investments

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Tax Loss Harvesting A Silver Lining In Bear Markets Financial Symmetry Inc

What Is Tax Loss Harvesting Ticker Tape